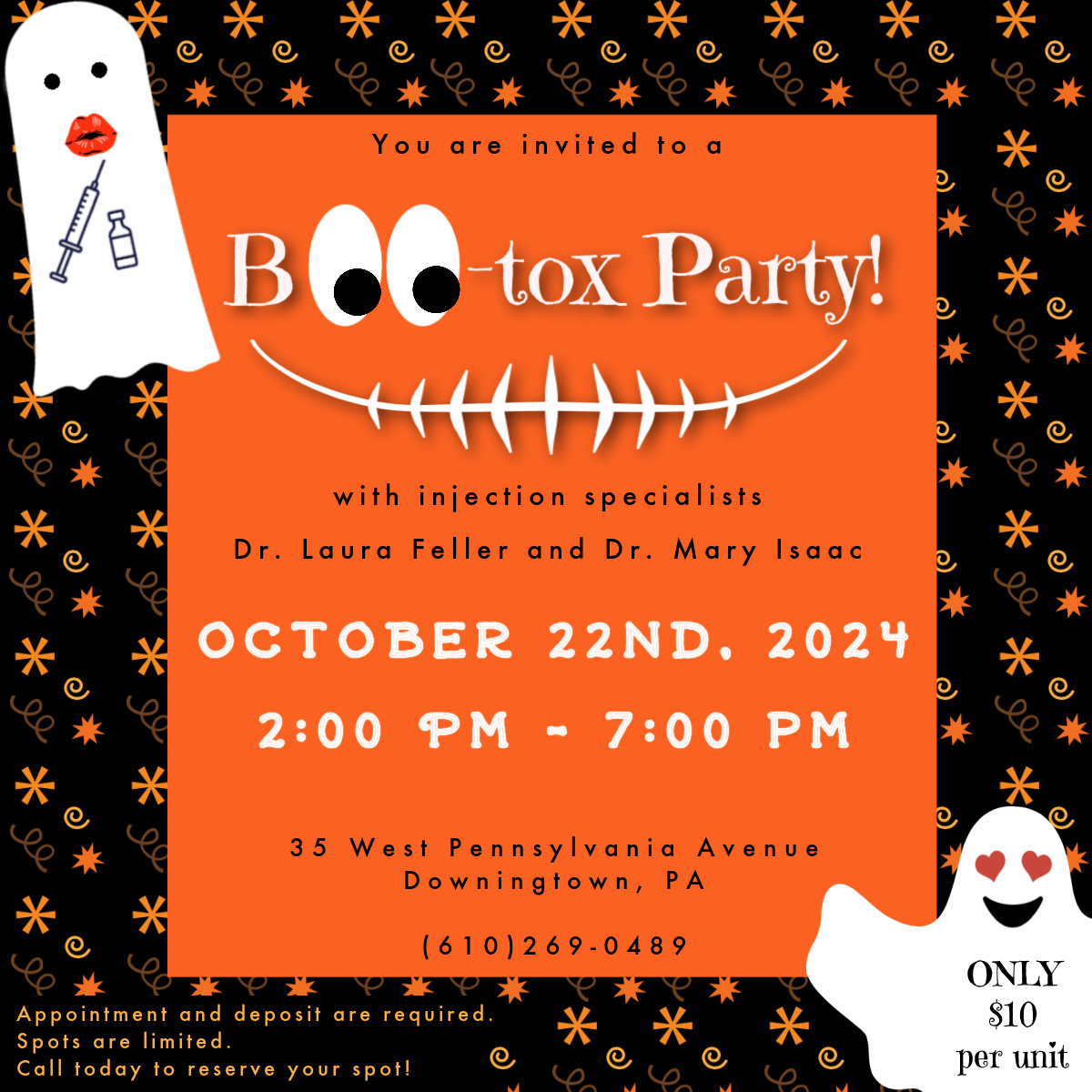

Join us Tuesday, October 22nd at our Downingtown office for a spooky, fun time! ![]()

![]()

Call to reserve your spot and take advantage of this discounted price!![]() 610-269-0489

610-269-0489![]()

BENEFITS OF BOTOX:![]() Reduce fine lines and wrinkles

Reduce fine lines and wrinkles![]() Prevent new lines and wrinkles from forming

Prevent new lines and wrinkles from forming![]() Reduce TMJ-related pain

Reduce TMJ-related pain![]() Reduce jaw clenching and teeth grinding

Reduce jaw clenching and teeth grinding![]() Treat excessive sweating

Treat excessive sweating![]() Treat chronic migraines

Treat chronic migraines